Our Mission

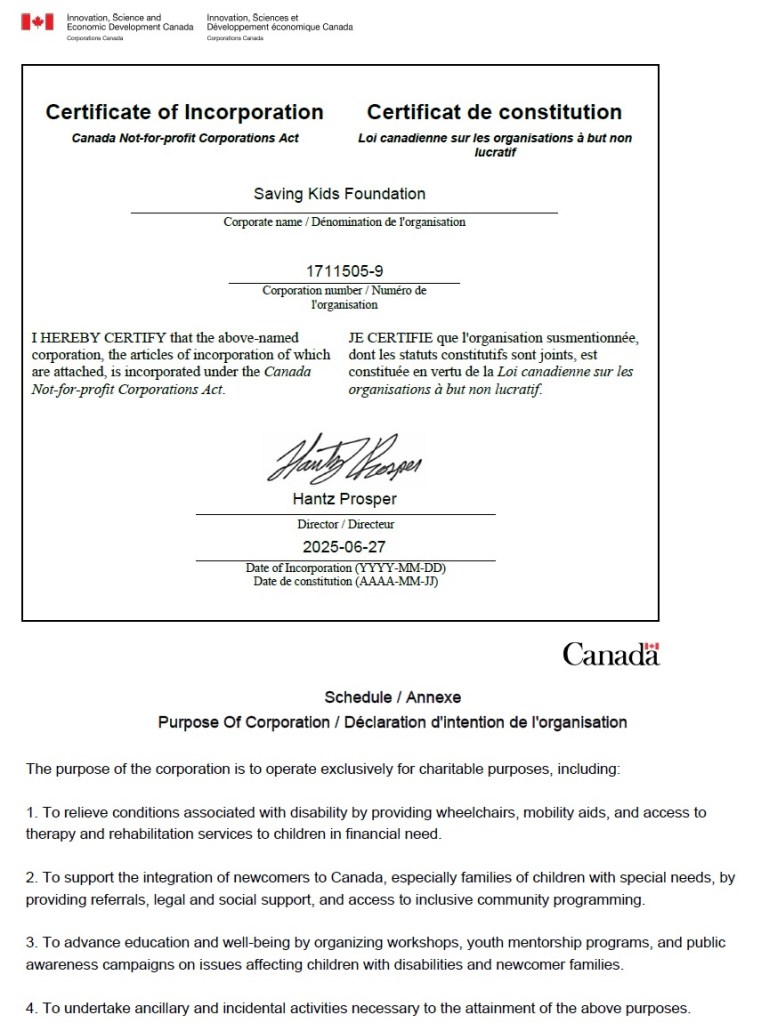

Saving Kids Foundation is a Registered Canadian Non-for-Profit (Registration No. 785757238 RR0001) committed to transforming the lives of children living with mobility challenges and families affected by socio-economic hardship.

We believe that every child—regardless of their physical ability or life circumstances—deserves the opportunity to thrive. That’s why we provide access to essential mobility aids, therapy services, emotional support, and critical family resources.

Through compassion, community collaboration, and national fundraising initiatives, we empower children and uplift the families who care for them—building a more inclusive and hopeful future for all.

Proudly Incorporated as a Federal Non-for-profit

We believe that every child deserves the right to move freely, play, learn, and dream without limits.

100% of your donation goes to life-changing programs for children—providing mobility aids, therapy, and essential family support.

Join us for a day, a project, or a journey.

Your time brings real change.

Together, we empower children.

Your generosity helps a child

move, grow, and thrive.

Every dollar counts.

Every gift makes a difference.

Celebrate your birthday, run a race,

Or host an event full of grace.

Turn passion into purpose today,

Help children in need find their way.

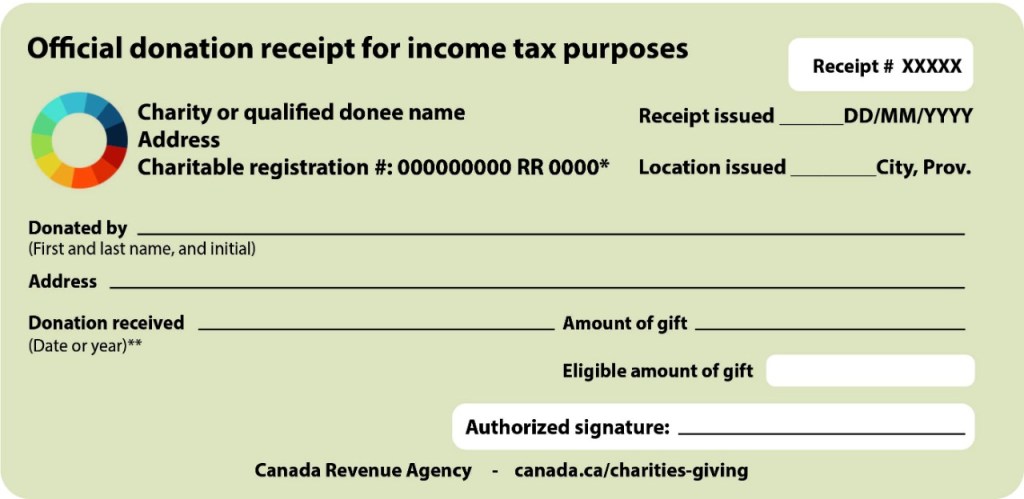

OFFICIAL DONATION RECEIPTS

🧾 Tax Receipts in Progress

Need a tax receipt?

At Saving Kids Foundation, we are proudly a Registered Canadian Non-for-Profit (Registration No. 785757238 RR0001), and we are currently working to implement a secure and compliant system to issue official donation tax receipts. we are not yet issuing tax receipts.

As outlined by the Canada Revenue Agency (CRA), issuing donation receipts is a privilege granted to registered charities. These receipts acknowledge your generosity and can provide tax benefits—but they must meet specific requirements to remain valid and compliant.

➡️ While we are not yet issuing receipts, we are actively preparing our internal policies and systems to meet all CRA standards.

➡️ Not all donations are eligible for receipting. For example, gifts must be voluntary, not in exchange for services, and made by the true donor whose name and address appear on the receipt.

➡️ If you need a receipt in the future, we encourage you to contact us now so we can understand your situation and ensure your contribution is eligible.

💬 Need a tax receipt in the future? Please reach out so we can better support your needs and confirm your eligibility as a donor.

We’re here to help! To issue an official donation receipt, we must confirm the gift and donor details. Only the true donor can receive a receipt, and the eligible gift amount must be verified. Please ensure your full name and address are correct.

Contact us today to confirm your donor status and learn how to receive your official tax receipt in the future.